Estimating risk free rate & Government bond

In every finance class or my previous blog here, financial analysis starts with the risk-free rate. The risk-free rate is the return you expect when bearing few risks.

When I took my finance class in college, the risk-free was the “easiest” number to get during valuation projects. I was taught that we generally use US 10-year government bonds as a long-term, risk-free rate. The action is based on two assumptions:

The US central bank can print money anytime if it cannot fulfill its debt obligations.

The US government is very unlikely to go into default.

I asked my macroeconomic professor a very genuine but seemingly naive question in the class.”:

So, the government can do that forever? It is like a perpetual motion machine.”

My economic professor, who is a lovely Asian lady but makes you feel like she is the kind of person who cannot find a job after a bachelor, master, and Ph.D. and then became a professor, said very relaxedly,

"Yeah, it is just like that."

(I will not disclose my college at this moment as I don’t want readers who enjoy my post to give the college underserved credit unintentionally)

Not until two years after I graduated did I realize that she was wrong.

The first assumption claims the government will never default since it can print more money to pay the debt. The logic that the government has the freedom to print money collapsed when several countries shared the same currencies as the European Union. While the US government has little probability of default, those investors, including previous me who only invested in US companies, have failed to diversify their portfolios to reduce the unsystematic and geographic risks. In addition, most large corporations today have businesses run and products sold globally. A developing country’s default will inevitably affect a multinational company’s risk. For example, companies like Coca-Cola and Nike have large sales in developing countries. Natural resources companies like Chevron generate the most revenues from developing countries because their home country needs both hypocrisy for its citizens and profits from overseas.

A government can print money unrestrictedly to pay off debt denominated in its own currency but may default on its government bond denominated in other currencies. That is why the Russian 10-year government bond has doubled (from 5.5% to 11%) since the invasion, even if the government is not likely to default.

A “hard to default” government keeps printing money will push up inflation. As a result, the investors will require a higher government bond yield to cover the value reduction in currency, like what happened in Turkey and Canada.

Why do we need to estimate the risk-free rate?

As I explained here, the risk-free rate is the benchmark we use to predict and estimate bank deposit and lending rates, mortgage rates, and expected returns from the stock market.

If a bank holds the US treasury with a 4% rate on its balance, it will be only sensible if it requires a higher loan and mortgage than 4% since it takes more risk by lending to individuals and businesses than the government.

Suppose the government bond only offers a 2% return like in the past decade. In that case, more investors will jump into the stock market than when the government is 4% since they cannot achieve their required rate of return for personal savings, children’s education, or retirement.

How is the risk-free rate determined?

When I took my investment class in college, my professor told us that the risk-free rate is the government bond determined by the U.S. central bank. When I used to watch CNBC, believing that it had useful financial knowledge, as my professors bragged about,

analysts, politicians, and business owners kept talking about how much interest rate the Fed (US central bank) would set. Some politicians frequently interrogate the central bank chairman about why they keep the interest high to cause “millions of American people to lose their jobs.”

But if you have some common sense, you know that the product's price is based on the relationship between supply and demand. While interest rate itself is not a product, people and businesses demand capital when they have spending or growth needs, while lenders supply them when they have extra money. So how much the rate lenders request from a government they think will have few risks to default.

The answer is the GDP growth rate + Inflation rate.

If the government bond lags behind the long-term GDP growth rate, investors will put extra capital in other low-risk businesses or investments.

If the government bond can not generate more than the inflation rate, people’s real assets will reduce even if the nominal value (face value) increases. Professor Aswath Damodaran collected data for Real GDP growth, inflation rate, and US 10-year treasury rate over the past 69 years and got the following data.

Source: Professor Aswath Damodaran, NYU Stern

As you can see, the central bank has been roughly following the GDP and inflation rate with a languid effect.

However, estimating different countries’ risk-free rates or future government bond yields requires more than data. I believe the great Professor Damodaran must know that, and I fully respect him. But I will try to add further explanation below for people with little financial knowledge and who want to learn from scratch.

Taiwan's risk-free rate

I am valuing the Taiwan Semiconductor company I bought several years ago recently; thus, I was observing Taiwan's 10-year government bond. I noticed that while Taiwan’s GDP growth has swung between 2% to 6% and the inflation rate is around 0% to 2%,

the government bond yield has been muted at around 2%. So why is that?

Taiwan's GDP growth rate

Taiwan Inflation rate

Taiwan's historical 10-year government bond yield

(Source: Trading economics)

My first reaction was that the Taiwanese government may try to manually manipulate the bond yield, and thanks to my personal interests in politics, I learned that the government has more leeway to control rate than Western counties, even if it is a democratic country. If that is the case, the Taiwan corporate bond should be higher, reflecting the part of government risk that has been subdued. But as you can see below, Taiwan’s corporate bond has also been low and aligned with the government bond.

Until I found the data below.

The real reason is that the Taiwan government generally took very little government debt; no wonder the government bond yield is low. In addition, during my experience of valuing other Taiwanese companies, I found that they also have a habit of taking little or no debt.

(Source: Trading economics)

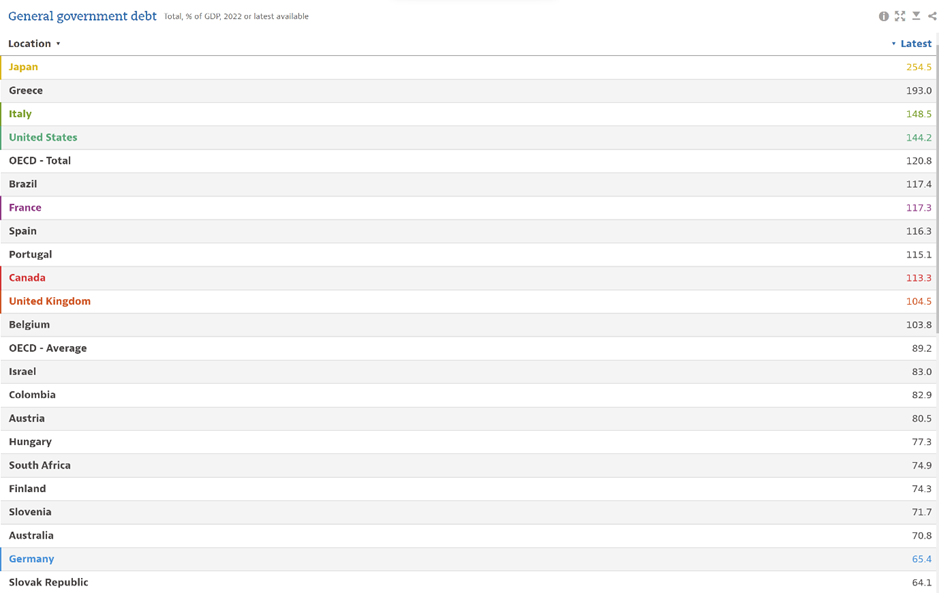

To give you an idea of how low Taiwan’s government debt ratio is, I attached the government debt/GDP ratios for other major economies.

(Source: OECD)

The next question is whether I should use the around 2% 10-year government bond or around 4% real bond yield (expected inflation rate + expected GDP growth rate).

If I were an accountant, of course, I would use the 2% as I would only be backward-looking. But I have thanked God frequently for not making me one.

But if I use the 4%, I may underestimate the company’s present value of future cash flow.(Because you divide the FCF with the cost of capital, including the risk-free rate).

I decided to use the seemingly “silliest” method, the average.

I think I can do that because I incorporate Taiwan’s long-term low debt/GDP ratio and the “teeny, tiny possibilities” (Phoebe Buffay, Friends) that the government may increase the government debt and issue more bonds in the future. The worst result I can get is to slightly overestimate the Taiwan government bond and underestimate the company stock price. But I would not be off a lot and underestimate usually only incurred opportunity cost (I miss the opportunity to buy an undervalued stock) rather than real asset loss (buying an overvalued stock).

After estimating the government bond yields of different countries in which your business operates in, you can subtract that rate from the country default spread, as I explained here to get the risk-free rate.

I hope you find this post helpful.