GEHC stock valuation update -Caption health acquisition and effects of General electric finishing spin-off

I published my first GEHC as part of my GE valuation before it spun off in January 2024, and I estimated GEHC’s intrinsic value to be $73.2.(All my previous analysis can be found on my website with time shown)

GEHC released its quarterly report on April 30, and the stock decreased to $76.3(over 11% decrease in a day).

In this analysis, I will update the GEHC valuation, starting with my last valuation and continuing with the new earning release.

In 2024, GE bought another company, Caption Health, for $127 million this year. I will also estimate the future value of Caption Health. (The most essential part of this analysis). I recommend you read the Caption Health valuation below first, then return to other items. Otherwise, you may get bored easily.

Finally, I will show how traders(analysts in institutions such as JP Morgan, Morgan Stanley, and Goldman Sachs) price companies. I never buy companies with their pricing, but knowing their behaviors can help me sell at a higher price. If you are too impatient to read this analysis and want to jump to the end to find the answer, it won’t help you buy stock at a low price and make capital gains.

If you have terms or numbers you cannot understand, please check my previous post to find clues.

Attention:

If you have questions regarding any accounting term or finance concept, please ctrl+F in this analysis. If you still cannot find or understand, feel free to comment below or email me.

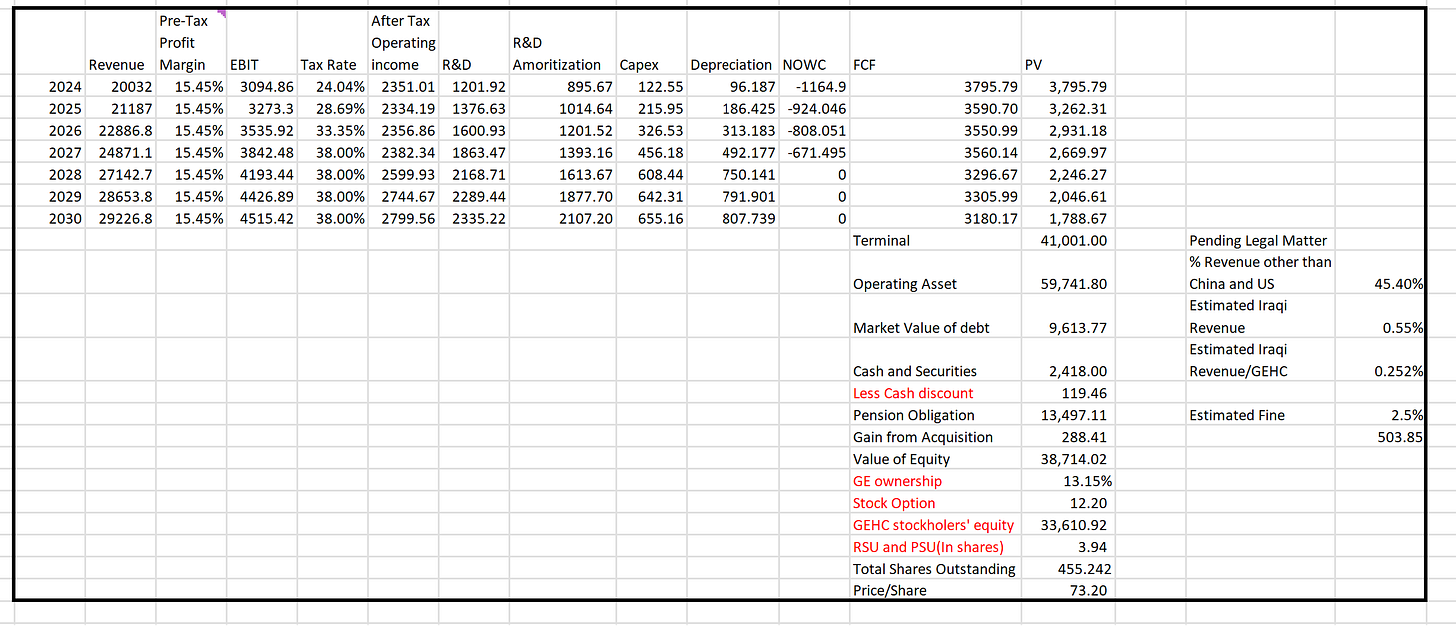

In my last GE valuation before it spun off, I estimated GEHC’s future cash flow and stock value as follows.

GEHC valuation on Jan 18,2024

The revenue growth rate is based on the following:

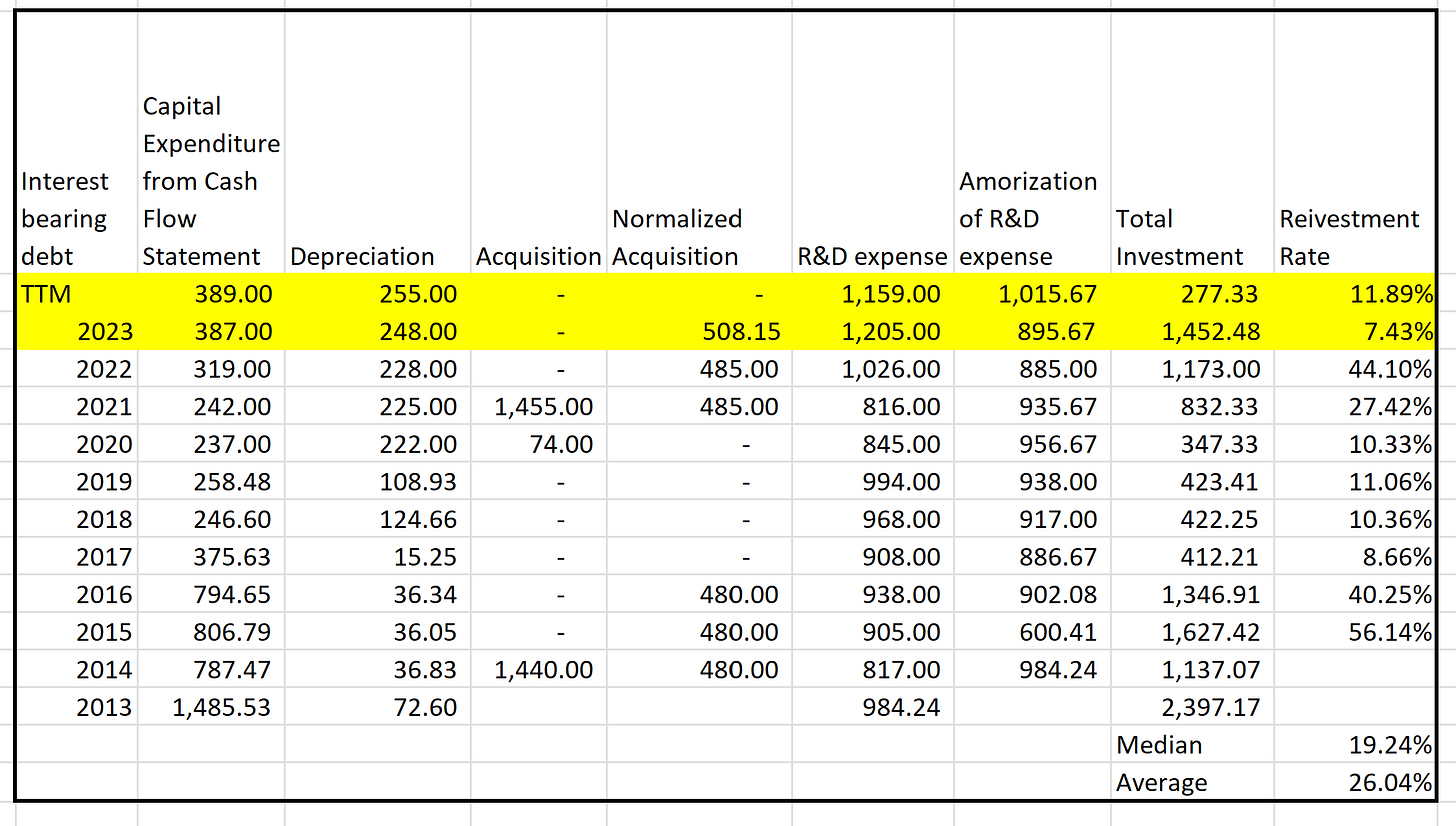

Reinvestment rate-how much money the company puts back into the company

Return on capital- how well the company generates returns from investment

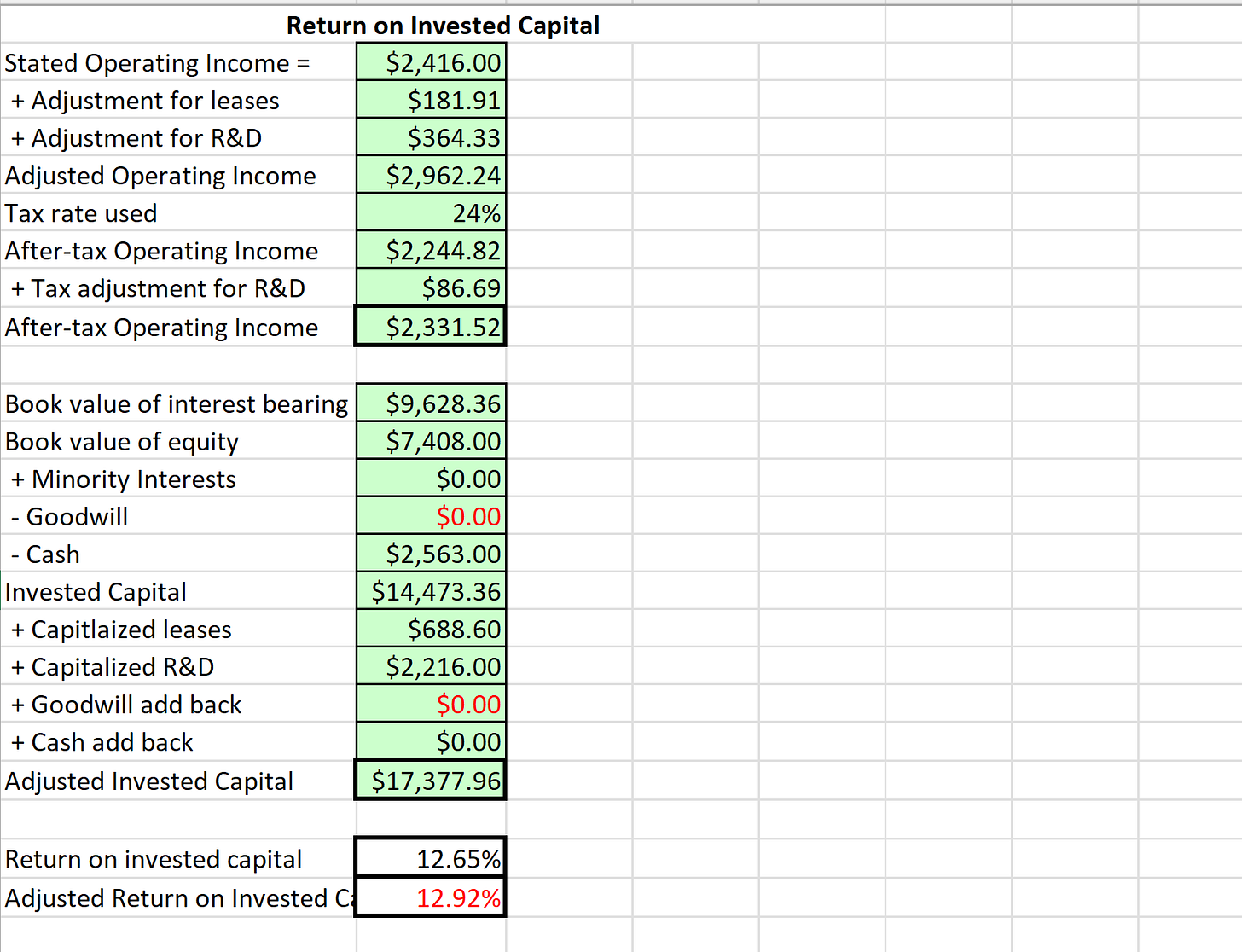

The return on capital is calculated as follows:

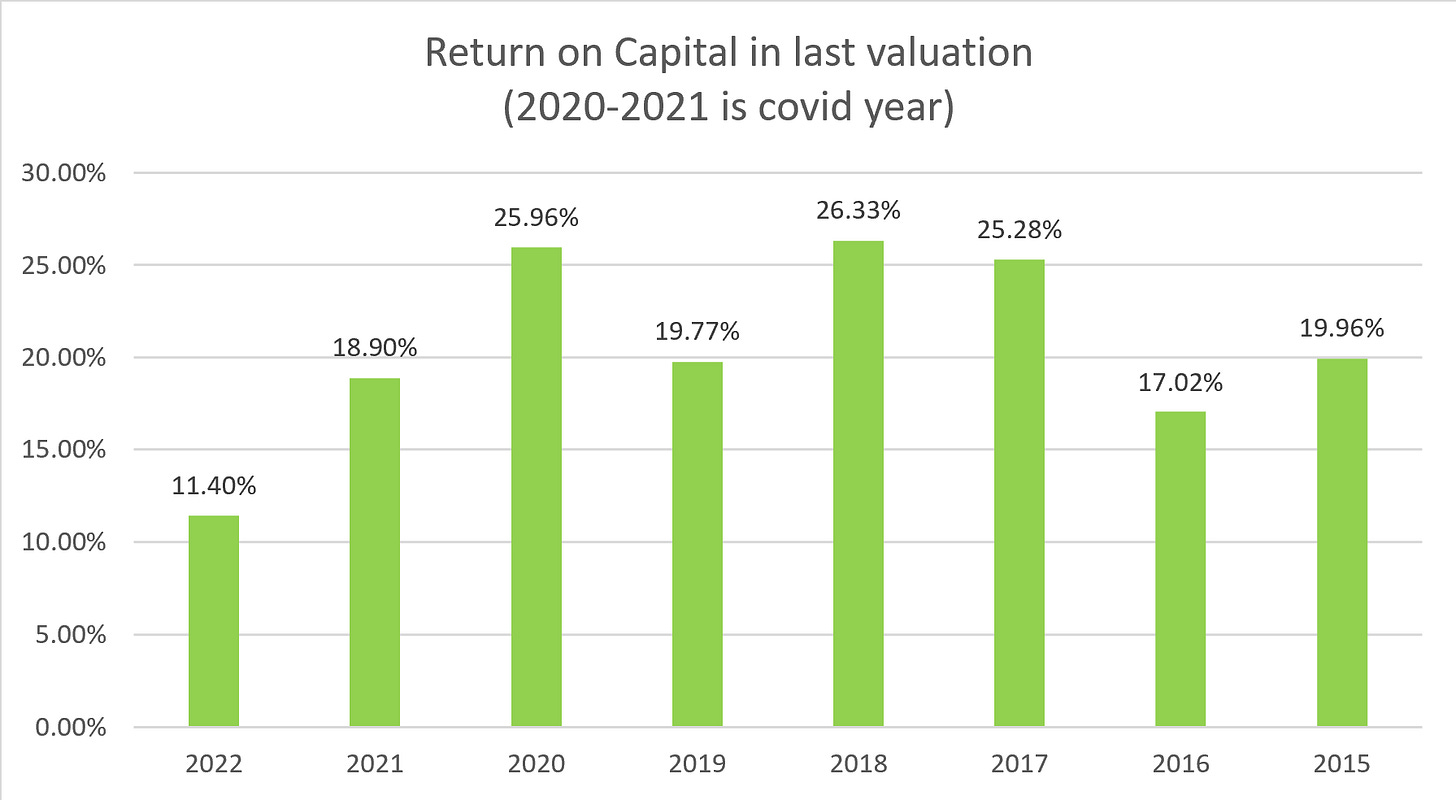

The following picture is just an example of how I calculated GEHC's return on capital for the year 2019, and I have done the process for the past 10 years.

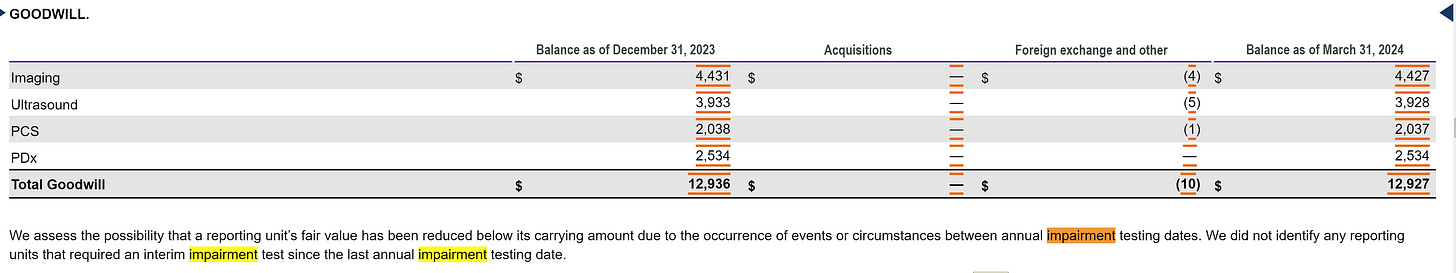

In calculating return on capital, I usually exclude Goodwill from the calculation. I have explained why I did that in my previous post. Please search “Exploded Return on Capital” in my last valuation. Explaining again here will be wordy. However, I choose not to exclude any goodwill in GEHC because the company has no goodwill impairment reported, implying that it does generate benefits expected from merger and acquisition. The information below confirmed my expectations.

With these processes, I calculated the company ROC as follows in my last valuation:

(The 2023 annual report had not been released when I finished the last valuation)

The historical median ROC for GE Healthcare, excluding covid year, is 19.87%, while the healthcare industry average is 14.28%. So, in my last valuation, I gradually increased GEHC’s most recent year’s ROC to 19.87%, then gradually decreased to the industry average. I feel comfortable doing that since GEHC is an old company, and the nature of the healthcare business makes it unlikely to scale up growth too much. It would be a very different story for GE Aerospace or companies in other industries like technology.

Forecasted GEHC ROC in the last valuation

I just calculated GEHC's trailing 12 months(the past 12 months to today) ROC with the most recent quarterly report and 2023. The current ROC decreased to 12.92%, and the 2023 is 11.99%; thanks to traders, the stock price is still slightly higher than the $73.2 I estimated, although the most recent ROC is even lower than my estimation. But since I only buy the stock when it is equal to or lower than my estimated value, the worst I can get is not buying it and missing some opportunity. No gain is not equal to loss.

Now, let us update the valuation to get the most recent intrinsic value.

GEHC TTM(trailing 12 months) ROC

Reinvestment rate

The reinvestment rate includes all investments the company puts back into its company. I usually included NOWC in reinvestment but excluded it in my last valuation for the following reasons:

NOWC consists of non-cash current assets and non-cash current liabilities that the company needs to maintain daily operations. If you want to learn more, you can learn about it in my previous post -Net Change of Working Capital (NOWC). GE accountants have NEVER disclosed how much current assets and liabilities belong to GE Aerospace, Power, Renewable Energy, and Healthcare, probably because they are CPAs. So, all my previous NOWC numbers are estimated. In addition, NOWC can be reinvested but should not be the major reinvestment. If I included NOWC as shown, the reinvestment rate would increase ten times since growth rate=reinvestment rate*return on capital. You may find that my estimate NOWC before is much larger than that of 2023 because I have little information. But if you check my estimated stock price, you will find that my estimate four months ago is quite close to the current stock price. To know why? Keep reading below.

Reinvestment calculation

Reinvestment rate in Jan 2024 valuation

With GEHC as an independent company, I can calculate its NOWC and have a better estimate now.

The following picture shows GEHC’s NOWC from all available financial disclosures. The number is negative, meaning the GEHC’s NOWC has increased its free cash flow. I don’t need to include that in reinvestment anymore, but I will estimate how long and negative NOWC is in the future by calculating the NOWC/Sale revenue ratio, gradually increasing the industry average in the Free cash flow calculation later.

GEHC Trailding 12 moth Reinvestment Rate update

It is important to notice that the trailing 12-month reinvestment rate can be very similar to last year's number at the beginning of the year since a company can wait later to make major investments.

Now, you can tell why the earnings are lower if you check the GEHC TTM(trailing 12 months) ROC and the GEHC Trailing 12-month Reinvestment Rate updates. When a company reinvests little capital and generates few returns, the operating income and revenue will decrease. I think the low reinvestment and return are partially due to the spin-off. When GEHC has just spun off from GE, management will tend to make a few changes to smooth the transformation. This is why the stock decreased, as traders in investment banks and other institutions only care about one quarter or year. However, as an investor, I forecast the company’s growth to be 5-10 in the next few years. I can estimate when the company will gradually increase reinvestment and generate more growth.

Estimated future growth rate

The following data shows my estimated GEHC future growth rate.

The GEHC median ROC(return on capital) excluding 2020 and 2021(covid year) is 19.87%. Why do I exclude? Because those are rare events that are unlikely to repeat, taking them into account will overestimate future growth. I updated The industry ROC 22.09%(I will explain soon). Since these numbers have few differences, I set the GEHC’s long-term ROC as 22.09%.

I gradually increased the current 12.92% ROC to 22.09% industry average in 3 years, then gradually decreased its historical median. The growth rate is the ROC*Reinvestment rate. I set the product for these two rates for four years, then gradually reduced to 2%(long-term GDP growth rate).

My story behind the numbers is that GEHC can gradually improve return on capital and increase the reinvestment rate to the industry average but will have an equal GDP growth rate after 2030. Why do I feel okay doing it? Because each company has its business cycle, it will have a declining growth rate even if it didn’t necessarily do worse. And no company can grow faster than long-term GDP forever. Why? If you have companies growing 10% forever, many companies must have negative growth rates (shirking) to make the long-term GDP growth rate 2-3%. Valuing a young or high-growth company would be a very different story. Based on their business nature, those companies can have higher growth for several years but will still decline one day. For GE Healthcare, I feel comfortable expecting that to happen sooner rather than later.

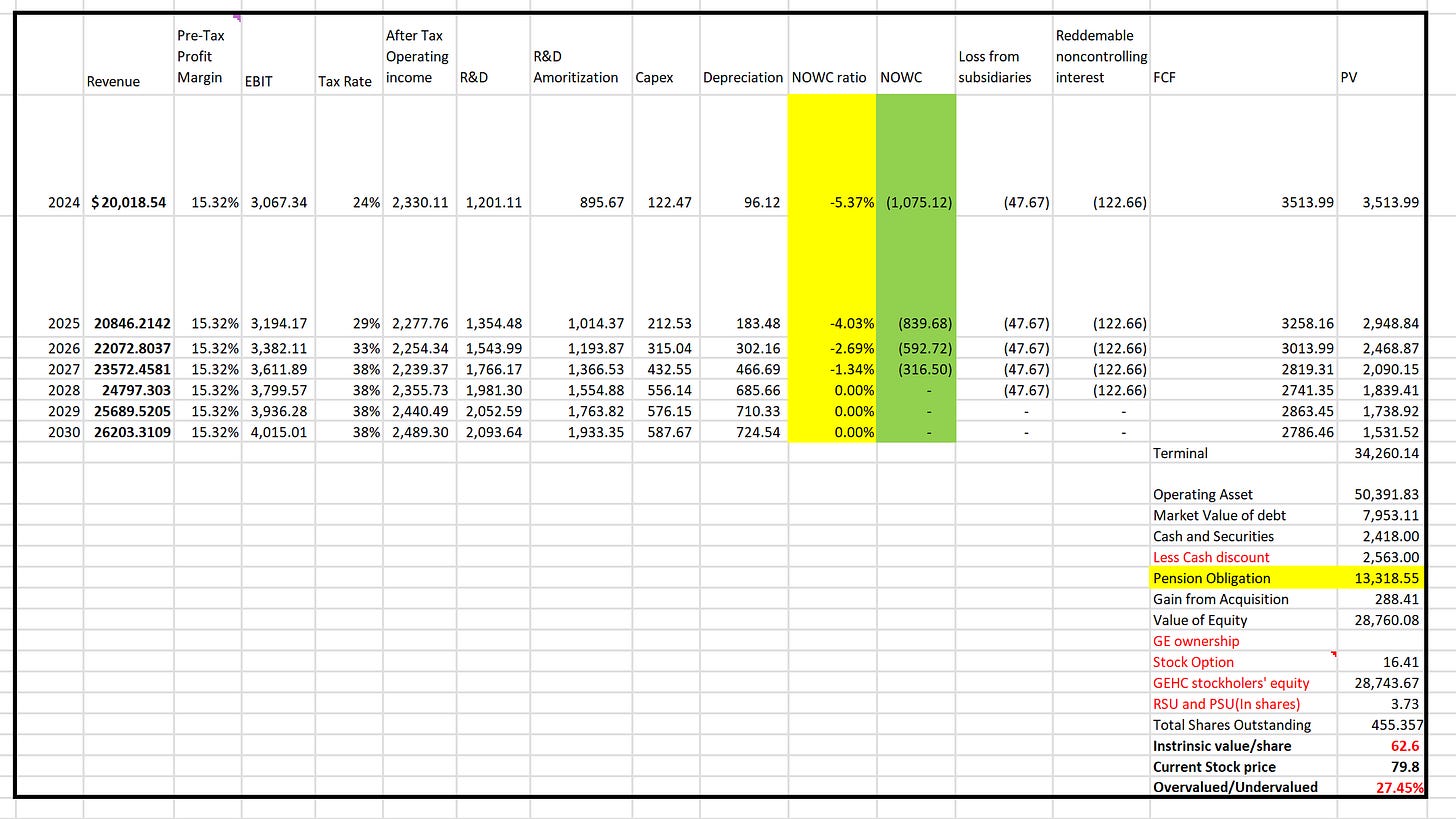

With these updated growth rates, the new forecasted GEHC revenue and stock price are as follows:(Not finished yet!)

I also updated GE(Aerospace ownership) from 13% to 6.7% based on GE(Aerospace)’s disclosure in the most recent filing. As an equity investor, you own part of the company. When GE(Aerospace) owns 6.7% of the company, the rest of the investors own the rest 93.3% of the company. However, should I subtract the GE ownership when estimating the intrinsic value of the stock price?

When valuing companies, I always need to estimate the value of stock options and subtract that from the total estimated operating assets because they are in addition to the outstanding common shares. If you are unfamiliar with stock options, check my previous post by ctrl+F Stock-based compensation. We need to value stock compensation because there are usually restrictions on how much to buy(strike price) and when to sell(vesting schedule). A stock option with 5 years of no trading restriction, for example, will be worth less than options with no restriction since there will be more uncertainty(risks) in five years. If GE Aerospace’s GEHC ownership has such a limitation, I will adjust accordingly.

The screenshot below shows GE’s GEHC ownership. While it says “contractual lock-up restriction,” the end date is May 15, 2024. In addition, if you use $2.6 billion/31.1 million, you will get the $83.6 per share stock price. With this information, I believe GE’s ownership has no differences from and is part of the total common shares outstanding. Subtracting that from total operating assets and dividing by the total outstanding shares will double count the shares. I validated my hypothesis later from GE's official website, which states that all of GE Aerospace’s ownership is common stock. However, figuring out is vital as you will always have uncertainty in valuation, which is excellent since too much certainty means too little potential gain.

Now, I feel it is okay to set GE ownership to 0 since the shares have no differences from other common shares, and the stock price increased from $59.9 to $64.2(still not the final number!) Looking at my GEHC valuation on Jan 18, 2024, you will see that I mistakenly subtracted GE Aerospace’s ownership, but the current price is still close to my estimate. Of course, I should keep revising my work to make as few mistakes as possible. But the good thing about investment is you just need to be less wrong than others rather than be correct all the time.

I still need to update the present value of debt and pension liabilities and check “Redeemable noncontrolling interests”(It is an accounting term, and I will translate it into human language soon), but as you can see, the intrinsic value before those adjustments has decreased to $63.9. I have no rush to buy the stock at the current price.

The devil in the details

When you finish estimating the reinvestment rate, ROC, revenue growth, and operating margin, you will feel “I am finally done.” And that is where you start to make mistakes. Whenever I finish free cash flow valuation, I browse the company’s most recent financial reports to see if I missed anything.

I found four items I must research from reading GEHC’s most recent 10 Q and 10k. However, sometimes, we are tempted to add or subtract unrelated items on free cash flow (depending on whether you feel the value you get is too low or too high).

A rule of thumb is to ask yourself:

Will this item or event affect the company's future cash flow, profitability, and risk? Don’t expect to find answers online or from other analysts. Most people will never pay attention to these items, and that is how you can have an upper hand if you can estimate.

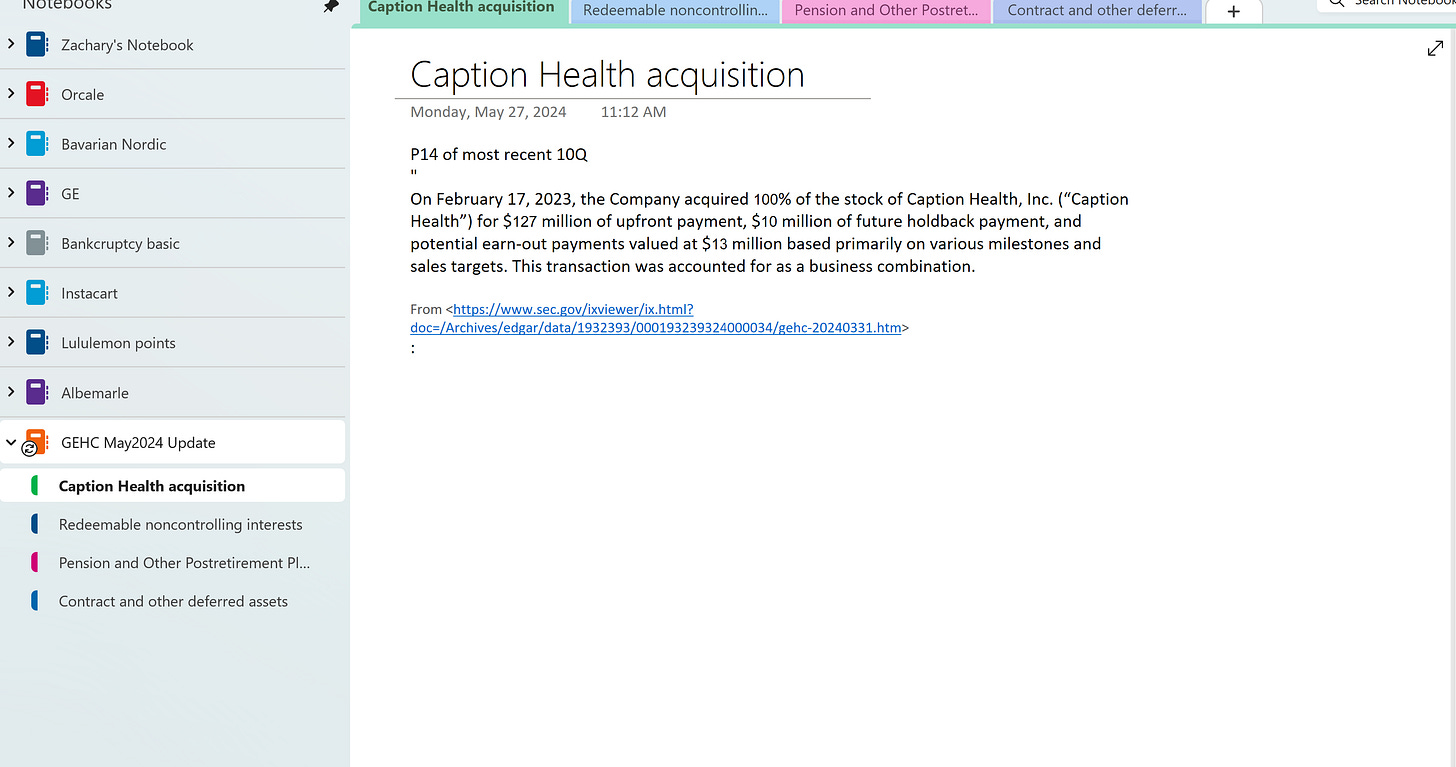

Acquisition

GE Healthcare acquired Caption Health, an AI health technology company testing heart disease with cardiac ultrasounds, for $127 million. Whenever a company acquires another company, the accountants and investment bankers will record the target company(the company bought by the other)’s assets and liabilities on the acquirer company. If the company spends $500 million but can only justify $100 million, for example, accountants will record another $400 difference as “goodwill” or “intangible asset,” claiming that the target company has potential benefit to come in the future.

However, over 50-70% of mergers and acquisitions in history end up losing money; we can not count on accounting numbers. You may wonder why many are losing money in M&A because companies usually go to investment bankers to find a target to acquire, and how much investment bankers get paid depends on the size of the deal.

If I come to you and say, “I have 10 billion to spend, and I will give you 10% consulting fees on how much I spend, could you advise me on some good investment?”You know what you will do, right? You will gladly take my offer, make me spend as much as possible, and advise me to spend around 9.85 billion dollars even if the investment is not worth that much.

So, when I value a company with acquisitions, I will estimate the value (not the price) of the target company as an independent company myself, compare it with how much the acquired company paid, and then subtract from or add to the acquirer company’s total operating asset.

What if I am wrong? I can always be wrong. But when most investment bankers are wrong for over 50-70% of the time. I only need to be better than them to beat the market.

Caption Health valuation

Valuing acquisition is no different from valuing other companies. I still need to do the same process-estimating revenue growth rate, profit margin, future cash flow operating asset, and present value of debt. However, the challenge with valuing acquisition is that most private companies do not disclose financial information. But there is always a way. You can estimate how much money a pizza restaurant or a convenience store in your neighborhood makes a year, even if you don’t know exactly how many pizzas or products they sell.

If I can know or estimate:

how much each Capiton Health cardio diseases AI testing service costs

how many people will use the service each year

I can forecast the revenue and free cash flow so that the value of Caption Health.

I got lucky and found that the service costs $299 from the company’s website each time by Googling “how much caption health service cost.” Many private companies may not disclose this number. However, you can always find information from public reviews for some products or AI testing services for other diseases.

Now, I need to estimate how many people will use the service in the next 5-10 years. It is important to ask the right questions when you make an estimate. One mistake many people make is “Make the answer the question.” Some people will search things like “How many revenues will Caption Health make for the next 10 years?” and “How much money can GEHC gain by buying Caption Health?”. It is like a test taker asking the teacher, “Should I choose A or B or C or D?”

My solution is to estimate how many people in the Cardio Health market(countries) will test for heart diseases in the next 5-10 years.

Then, estimate how many percentages of people testing heart diseases will use AI technology over traditional services Or how many health providers will switch to AI technology from traditional services.

Then, estimate how many percentages of heart disease tests done by the AI technology market will go to Caption Health.

Many uncertainties are involved in this process, which is great since I have more opportunities to win over those investment bankers who are wrong 50-70% of the time.

Estimating how many people will use the service each year

I collected data from the CDC about how many hospital visits for heart disease, and the most recent number I can get is from 2019. I feel it is okay to use the 2019 number because hospitals mainly deal with COVID-19 during 2020-2022 and will not take as many patients, and this is the best number I can get.

Then, I used the visits divided by the US population to determine how many percentages of the population visited for heart disease. In 2019, 3.96% of the US population went to a hospital visit for a heart disease check.

I also collected information like heart disease death rate but later realized that the death rate may not imply an increase in potential testing sales. In fact, the heart disease death rate can even be negatively correlated with the testing sales because common sense told me people who died from heart diseases are more likely those who rarely did health checks.

But my next challenge is to estimate:

How many percentages of heart disease checks will use AI over time?

How much of the AI-testing heart disease market share will Capital Health have?

How many percentages of heart disease checks will use AI over time

I cannot find information regarding how the percentages of heart disease testing use AI right now. But I can estimate when all heart disease testing uses AI technology.

So, suppose I think by 2030, 100% of US heart disease testing will use AI. I can set 100% for 2030, 83.3%(100%-(100%-0%)/6) for 2029, 66.7% for 2028, and so on…

I know the real number will be different, but even if the US achieves 100% AI testing for heart diseases in 2035 versus 2030, for example, the present value of those revenues would not be much different after discounting the cost of capital.

Estimated total US heart disease visit by 2030

This link from the Mayo Clinic shows 7 ways to check heart disease, including: ECG(electrocardiogram)

Holter Monitoring(ECG used by portable devices like Caption Health)

Echocardiogram(Ultrasound-Caption Health machine in hospital)

Exercises or stress tests

Cardiac catheterization(Tube inserted in body)

Heart CT(X-Ray rotation machine)

Heart MRI(magnetic field)

I don’t think most people will count on Exercise or stress tests, so I take shortcuts and expect 3/6(50%) of all future tests to estimate the total market of capital health with many other companies. (3/6 since Caption Health uses ECG and Ultrasound based on my research). I started with 8.33%(1/6 of 50%) and gradually increased to 50% because AI still takes time for hospitals to switch from traditional technology to AI.

Estimated Heart disease checks with ECG or Ultrasound over time

How much of the heart disease market share will Capital Health have

While I estimated the total number of heart disease visits in the US by 2030, I can not directly use the number as there will be not only Caption Health but also other companies offering such services. Since all health technology needs FDA approval in the US, I searched for data about all FDA-approved AI-health testing technology.

This link from the FDA(US Food and Drug Administration) lists over 680 approved Artificial Intelligence and Machine Learning (AI/ML)-Enabled Medical Devices.

Then, I filtered the data with those testing heart diseases like Caption Health. (Some AI technology is used for MRI, tumor, teeth, or gynecology(women's disease), so they are not Capital Health’s market competitors). I checked each approved FDA AI technology summary in this link and counted how many are used for cardio-cardiovascular with AI. The link from FDA is excellent since you can download the list as Excel and click each Submission Number to direct you to the link. It's not a rock science, but it just needs some patience and common sense. The best part of this kind of research is I can always learn something new, and I learned about much medical knowledge as an additional benefit in this process. When doing data refinement, it is important to be honest with yourself in your judgment. Ask yourself whether a company provides a similar service technology to detect heart diseases with electrocardiograms. If a company tests heart diseases using methods other than ECG or ultrasound, I will not include the company in the sample here. Since I have multiplied the total future market size by 3/6, I will double count if I include other methods of cardio disease testing, underestimating Caption Health’s value.

An investment banker who advises the target company for an M&A will include companies that do not offer the same services and products as Capital Health, increasing potential real competitors to make the company look cheaper than it should be. He will say: “Your company has so many competitors, so the $127 million GE paid will be more than how much you are worth”.

Another one who advises the acquirer to buy Capital Health will filter out potential competitors to make the company look more valuable than it should be. He will say: “

Caption Health has a great future as everyone will use it to test for heart diseases. So you got a good deal for only spending $127 million”.

For the same company, investment banks on two sides will give you complete conflict information. To invest in the company, you have to estimate the companies with your own judgment and common sense and don’t lie to yourself like them.

After checking 680 FDA-approved technology, I found 47.24 of them are for heart diseases check with ultrasound or ECG. You may wonder how I could get .24. There are some technologies used for not only heart diseases but also other diseases. So if one AI technology is for 6 diseases, I just count 1/6.

You may think checking information about 680 technology is too much to finish. I did not check all 680. I first find duplicate data with Excel since some technologies have been approved in multiple years, and then I exclude some technologies by names. For example, I saw some technology called LiverSmart and BoneMRI. I directly exclude them from my data without checking. Always use the common sense to work smarter!

Right now, I can safely say that at least in the US market, 46.24 other companies are sharing the market for heart disease checks with ECG or ultrasound with Caption Health. I have something to base on! Notice that I also included other GE Healthcare technology in the sample. Because GE Healthcare has had ultrasound technology for decades, its original business will also take part of the market share Caption Health should have had. Excluding them will overestimate Caption Health's value.

FDA-approved AI technology for heart disease check with ultrasound or ECG.

With this information, I estimated the present value of Caption’s health operating asset is $180.71 million, as shown below. Notice that I have an item called “PV of potential future payment.” because GE Healthcare disclosed that the acquisition has “$10 million of future holdback payment and potential earn-out payments valued at $13 million based primarily on various milestones and sales targets.” This context means that GEHC needs to pay additional money if Caption Health achieves certain targets, such as sales revenue, in the future. So I expected Caption Health to achieve that milestone in 5 years, and then the present value of future GEHC payments will be $23 million/(1+Cost of capital)^5.

Captaion Health Free Cash Flow

GEHC has paid the acquisition by $127 million with cash, so we will deduct that again as the company’s most recent cash balance will show the current balance after the payment.

However, if you value a company by taking debt or issuing shares to make an acquisition, you also need to evaluate the cost of those items.

Now, I will explain how to evaluate other items.

Attention: I valued the following items before I valued the Capiton Health acquisition. So the value changes you will see below has not included the acquisition value until the end.

Redeemable noncontrolling interest

Noncontrolling interest is an accounting term. In human language, if company ABC owns 49% of company XYZ(or less than 50%), ABC has a noncontrolling interest.

Redeemable noncontrolling interest

Now, suppose company JQK owns 20% of XYZ with redeemable controlling interest.

Company JQK has the right to ask ABC to purchase 20% of the total based on certain conditions.

Effects on valuation

Since I am valuing GEHC’s value, I will need to estimate the value of GEHC’s ownership of other companies and add it to the total operating assets.

Since GE has a redeemable noncontrolling interest, I must also estimate its value and subtract it from the total operating assets. GE must purchase it if a third party requires it, even if the noncontrolling interest keeps losing money, has legal issues, or is at the average of bankruptcy because the third party has redeemable rights.

The best method is to value each company GE has stakes in as an independent company and then multiply the estimated value by how many percentages of the company GE owns. I covered this in my previous valuation of 70 Oracle’s acquisition, and you can check that if you are valuing companies with cross holdings.

But not surprisingly, GEHC accountants disclosed no information about its cross holdings except how much income they had from them. You can check my previous post and search “Parent vs consolidated income.” to learn about accountants’ insidious way of reporting them.

Value of GEHC’s ownership of other companies

Considering that GEHC has never had a positive net income from its subsidiaries, as the pictures below show, I will subtract $47.67 million(average of net income loss from its subsidiaries from the last three years, and the company only has three years record after spun off) for next five years. After five years, I expect the company will get rid of the subsidiaries, and the effect will be small, even if it keeps losing money due to the time value of the money.

Redeemable noncontrolling interest

The picture below shows that GE paid $211 million for some redeemable noncontrolling interest holders. To translate into human language:

Some holders of GE’s subsidiaries or cross-holdings don’t want their shares anymore, and GE has to buy them back due to conditions in the contract.

Again, we don’t know how many holders are there holding how many of GEHC’s subsidiaries since accountants didn’t tell us. So I take a shortcut to subtract $122.66 million(average of three-year distribution as picture shown below) for the next five years.

The intrinsic value changed little, but only because the subsidiaries have very small sizes compared to GEHC. If you value Yahoo in 2006, for example, the story will be very different since Yahoo owns 40% of Alibaba(Amazon equivalent in China). The company’s value is almost all from Alibaba, as no one uses Yahoo anymore. Or if you value any of the Indian companies Tata Motors, Tata Steels, or Tata Consultancy, the subsidiaries will be a mess since they have certain stakes in each other.

GEHC FCF after adjusted noncontrolling interest

Pension liabilities

Pension funds are pools of money contributed by employers or both employers and employees to provide retirement income. The pension fund invests money that is contributed to generate employee payments after retirement. The company has to add more capital if the fund cannot generate enough returns to pay employees in the future. Since stockholders get paid after everyone else, the more capital spent on the pension funds, the less will be left for stockholders. The company also disclosed in its 10k annual report that the pension fund is unable to cover all retirement liabilities and will use the company’s cash to pay it.

GEHC funding pension fund

In my previous post, GE pension fund, I explained how accountants record pension liabilities and how it tells nothing about the present value of the pension fund. You can check that post if you are interested in how accountants work.

In my previous post, I collected data about GE pension fund return(reported in the GE annual report) and calculated their standard deviation(how volatile the data is). I used 7.8%(the calculation has little differences due to Excel) in my last post since:

The standard deviation is low for ten or 25 years, implying that the data is more stable.

Since GE has announced that it will no longer contribute new pension funds, only some current employees will have pension funds. These people are likely to retire within the 10-25-year time period.

GE(before spin-off) pension fund return on Jan 18,2024

Then, I calculated the present value of the pension fund by using the 7.8% discount rate. For example, the 2025 pension fund value is 5075 million, so I use 5075/((1+7.8%)^2). Just like calculating how much money you need to save today if you want 5075 million in 2 years with a 7.8% interest rate.

Estimated present value of GE pension fund on Jan 18, 2024

I estimated the GE pension fund for each sector based on ratios of employee headcounts since GE accountants never disclose details about the pension fund for each sector, and the pension fund is highly correlated to employee numbers.

Estimated GE pension fund by sector on Jan 18, 2024

Estimating the present value of GEHC pension liabilities after spin-off

GEHC disclosed how it invested in the pension fund on its annual reports. As the picture below shows, it invested:

18% in Global Securities

54% in debt securities

7% in real estate

21% in Private equities for its Principal Pension Plans, for example.

(Debt securities here refers to GEHC lends money to others)

So, I collected the long-term average return for different types of securities, calculated the weighted average return rate, and discounted future pension fund liabilities to today. I know that the pension fund may not be able to generate the average return, but this is the best number I can get.

I subtracted the present value of the pension fund from GEHC’s present value of the future operating assets, and I got $63.8 per share. But I found I may have made a mistake.

GEHC intrinsic value per share after pension obligation on May 2024

Companies invest capital to buy assets(debt, equity, real estate) to generate a return to their pension fund. At the end of the day, these assets in the pension funds also have value, and the company can sell them for cash to pay the pension funds. If I only subtract pension fund liabilities from the company’s value, I will fail to consider asset value and overestimate the pension liabilities. For example, if the GE pension fund purchased some real estate and used rental income to pay its pension fund, I would exclude the real estate sale value if I didn’t consider pension fund assets.

Pension fund assets

I started with the pension fund asset reported by accountants. In accounting, fair value is the accountant’s estimate of the future price to sell an asset. If you compare the two pictures, you will find that GEHC’s pension fund’s “fair value of plan assets.” has decreased, and the fund deficit has increased, although the company has been adding capital to the pension fund with cash on hand as the picture above,” GEHC funding pension fund,” shown. If GEHC’s accounts’ fair value estimate is reasonable and reflective, that would not happen.

It would be great if I had more data to understand better how the fund is performing, but I only have 2 years of GEHC annual reports. Considering that GE has been losing money in its pension fund so much that it has frozen it in 2021(link), I don’t think I would believe in accountants’ estimated fair value of plan assets. So what should I do?

GE pension fund status for the year ending Dec 31, 2022

GE pension fund status for the year ending Dec 31, 2023

I will do something that makes you and me very uncomfortable. I will not give any value toward the pension fund assets. Why? GE announced the freeze pension fund link in 2019, but the pension fund has been underfunded and has to ask for additional cash from GE for five years after that. I have no reason to believe that the GEHC pension fund’s manager can suddenly outperform from now on. There is a possibility that the company can reduce the fund dramatically one day, reducing the liabilities and increasing the stock price, but the worst scenario for me is that I did not buy the stock.

I have another reason for making me more comfortable with the intrinsic value, and I will explain that soon when I explain how traders price the company.

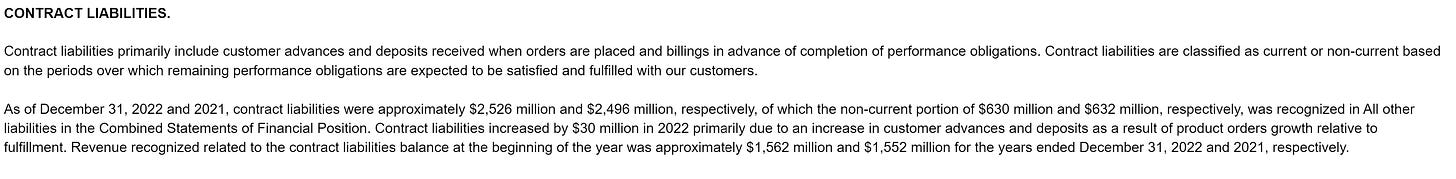

Contracts and other deferred assets

You may know these items, but I will explain them here for people who have little background information or are confused by accounting jargon.

I located these items when calculating the company’s NOWC-Net change of working capital- one of the line items in the Free Cash Flow Model. You can search my previous post quoted on the top if you don’t understand this item.

The NOWC is equal to non-cash current assets minus non-debt current liabilities. So, I started with current assets and liabilities on the company balance sheet.

But you will often see accountants report two line items called “All other current assets” and “All other current liabilities.” I usually ctrl+F these terms in the company's annual and quarterly reports to quickly locate them.

Again, when deciding whether to include them in the free cash flow, asking yourself:

Whether this item will increase or decrease the operating cash flow?

The following picture shows details about GEHC’s other current assets. You will find that most of them are financial assets rather than operating assets.

(Financing assets are companies' investments in equity and debt while operating assets are assets for daily operation).

We estimate operating assets from operating cash flow and then add or subtract financing assets because they have different risks, returns, and natures. One example is the Prepaid pension asset in the picture below, and we estimated its value and effect separately after estimating operating cash flow.

You can tell that the only items we need to learn more about is the “Contract and other deferred assets”.

GEHC all other current assets

The following picture from the company's annual report shows the definition of contract assets. I will first explain how accounting works and then transfer this into human language.

In accounting, accountants only consider revenue earned if the company delivers the product or performs the service. For example, if you pay an annual membership to your gym in January, accountants will record one month of contract assets to the gym balance sheet at the end of January and 11 months of membership fees of contract liabilities. Their logic is that the gym hasn’t delivered you 11 months of services/products, so the gym “owes” you 11 months of services.

Since I estimated future annual revenue and free cash flow, I don’t need to care about these items. Accountants made up those items just for their convenience rather than reflecting the business. I pointed out these items since accountants reported them as “All other assets” and “All other liabilities.” You may be unsure whether to add them to free cash flow in your valuation.

Since the contract asset decreased free cash flow(you hold some product or services but have not sold), while contract liabilities increased free cash flow(you made a sale first without paying the cost immediately), I don’t need to do anything with them in my NOWC calculation since current asset and liabilities has included them.

The whole process is to tell whether each item on current assets and liabilities affects the NOWC so that free cash flow.

All items below can be found in the company financial reports. I exclude cash, financial assets from current assets, and all other non-operating or interest-bearing items from current liabilities, then calculate the NOWC/Sale ratio.

By doing so, the NOWC/Sale ratio is more reflective of how much NOWC the company holds for daily operation, and I always subtract the present value of debt, pension, and operating leases separately at the end.

NOWC/Sale revenue

I set -5.37% as the 2024 NOWC/Sale ratio and gradually increased to 0%. A negative NOWC increases the free cash flow because the company can carry more current liabilities than current assets. However, as the company ages and declines, the negotiation power will dwindle, and the increased cash flow from the negative NOWC effect will also decrease.

I set the end-year NOWC/Sale to 0 rather than the industry average since I believe GEHC’s corporate power can make it maintain about the same current assets and current liabilities over the long term. To translate into human language, I think GEHC should be able to simultaneously purchase products on credit (pay suppliers cash later) and make sales on account (receive cash payment for products sold later).

If you are valuing a small company with little bargain power, you should set the NOWC/Sale ratio to positive(decreasing free cash flow) over time, as they may not be able to purchase products on credit (pay suppliers cash later) for a long time

Adding the present value of Caption health, I estimated the GEHC’s intrinsic value (the price at which I will buy) is $66.3

Pricing

Now, I will show you how traders in investment banks price the company so that they know when to sell.

Suppose a new college graduate made $5000 a month for his or her first job. And someone asks you to estimate how much asset he will have when he is around 35-44.

If I estimate as an investor, I will not only learn about how he or she performed compared to other employees but also learn about:

Does he take the initiative to solve problems when he is not asked to?

Does he or she learn to keep learning new skills and technologies even if not required by work?

How is his or her lifestyle? Does he or she smoke, drink, or work out regularly?

How much of his or her monthly salary goes to rent, groceries, mortgage, credit card payments, or investments such as bonds or stocks?

Does he or she have parents to support and plans to have kids, and how many?

Does he or she have heart disease or hepatitis?

All these questions will affect his or her assets with how long he or she can work, how much promotion and additional salary he or she could get, how much expense he or she will pay, and what investments he or she will make in the future.

If a trader(like people who work in JP Morgan, Goldman Sachs, or Morgan Stanley) prices the same person, he or she will collect information about thousands of retired people, their ending assets, and the annual salary they had when they had their first job. They used each person’s ending asset to be divided by their first job's annual salary to get a ratio. For example, if the average net worth for a person retired between 35-44 is $135600 and his or her first annual salary after graduation is $60000.

Traders will tell you that the industry Asset/First salary ratio is 2.26(135600/60000), and a person with an Asset/First salary ratio lower than 2.26 has more potential to grow(or cheap, suppose you can buy it).

What’s the issue with such a method? The issue is that they assume that every new graduate with a similar first job salary will take a similar amount of debt, learn similar skills, and pay similar rent, grocery, medical, and insurance costs. As a result, they will miss some genius or future CEOs if a young employee has a low-salary entry-level job and overestimate a person’s future assets if they have a high salary because their business is booming right now. By the same token, they will miss great young companies that may be losing money right now and overestimate soon-declining companies with current high earnings. Take a look at some COVID-winner companies like Peleton or Zoom. These companies had skyrocketed stock prices due to dramatic revenue growth during the lockdowns but failed to maintain growth without a sound business model.

However, I started to estimate traders’ pricing based on my investing experience on Facebook because they can help me sell at a higher price if I know what they will do.

I still only buy the stock at or lower my estimated intrinsic value since I invest but do not trade.

Price/Earning ratio pricing

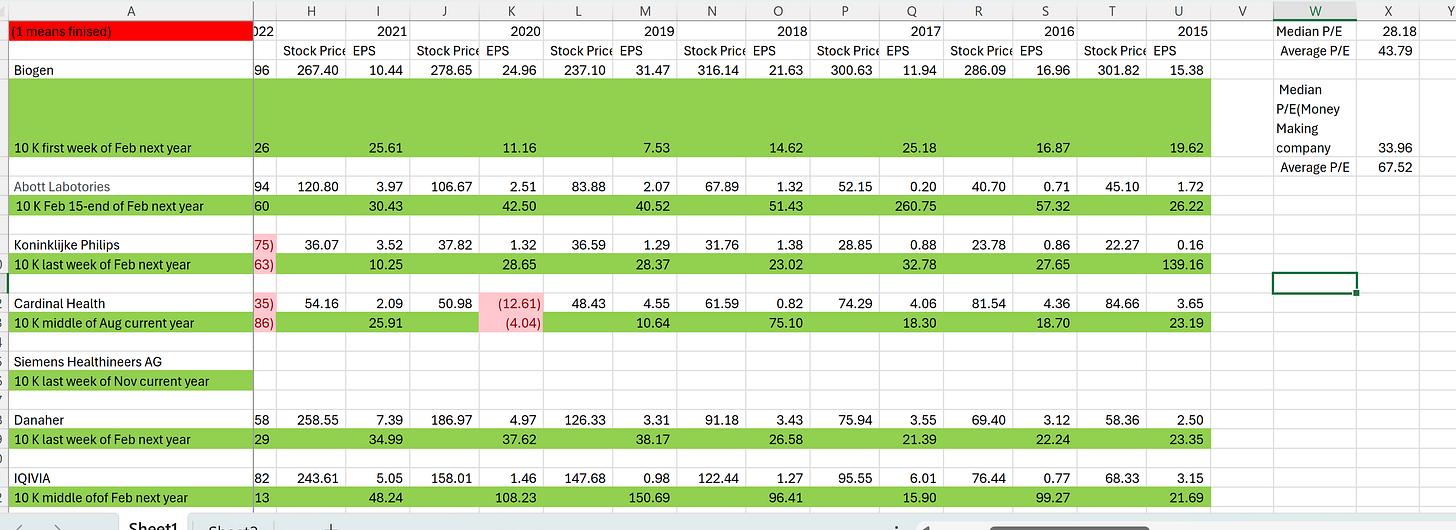

I try to find Prices/Earnings from datasets such as NYU and Morningstar. However, they usually use P/E for healthcare products and P/E for healthcare technology separately. It is expected as pricing is trying to find the shortcut with the expense of specification. So, I did my own research to find companies that are similar to GEHC in both designing medical devices and healthcare technology.

I found 40 companies, collecting their annual earning per share and median stock price in the past 10 years. The median P/E for GEHC’s industry is $28.18, and for the money-making company is $33.96.

A screenshot of self-calculating GEHC industry P/E

Price/Sale ratio pricing(Attention!)

The healthcare industry has a feature that it takes longer for companies to make a profit, and many companies have some years of positive and negative earnings.

As an investor, I will analyze when the company can turn negative earnings into positive earnings and gradually increase operating income in the future cash flow.

Traders (investment bankers, equity analysts, fund managers) are too impatient to do that and will instead use price/sale revenue ratios. So if a company is losing money but has 500 million dollars(sell price*product sold) a year, they will use stock price divided by annual sale revenues and the price/sale ratio to price company.

You should never use the price/sale ratio to decide when to buy a company! But I will calculate to replicate traders and find the SELL price. Here is why:

A company’s finance comprises assets, liabilities, and equity. You may not know these terms, but I will explain them.

Suppose you want to run a convenience store. You have $40,000 from your savings and take $10,000 in loans. You get cash when you take the loan and have liability(owe the bank).

Your asset ($50000 cash)=$10,000 debt(loan)+$40000 (equity).

The equity is left over after you pay off your operating expenses and debt.

Now, suppose you made $30000 in income before paying loan interest and debt. This is called operating income.

Your asset $80000($50000+30000)=$10000 debt (loan)+$70000(equity $40000+30000)

But you also need to pay interest on your loan. Suppose you pay $2700 for year one ($1300 for interest expense and $1400 to pay off the loan amount)

Your asset $78600($50000+30000-1400)=$8600 debt(left loan 10000-1400)+70000 equity

You will wonder whether the $1300 interest expense goes. The accountant reports them as current-year operating expenses and usually does not include them in the balance sheet. I also don’t like what they are doing, but I show you how it works.

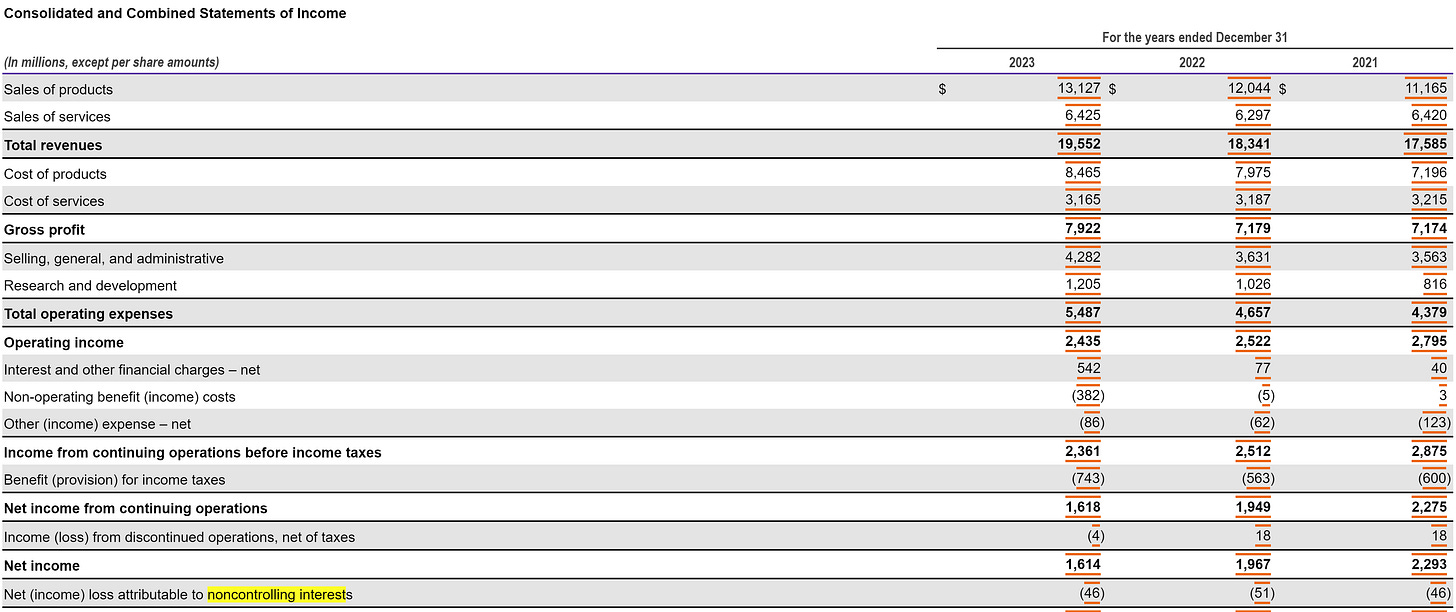

The following picture shows GEHC’s most recent annual report income statement.

The total revenue =product/services sold*per product&service price

The operating income =total revenue-operating expense(except tax and interest expense)

The net income=(operating income-interest expense)*(1-Tax)

The EPS(earning per share)=net income/total shares outstanding

After you have learned these items, let us come back to the following equation:

Now, I want to consider whether the following items are assets, liabilities, or equity items.

-Sale revenue

-Market Capitalization(Stock price*Total shares)

You will see that Sales revenue is an asset item while Market Capitalization is the equity item. So, by using the price/sale ratio, you are mingling the asset number with the equity number. I would argue that a trader or analyst will find companies largely indebted to cheap when using the price/sale ratio. The market will punish a company with a lower stock price when it has a large amount of debt, but the price/sale ratio treats every company differently.

I collected median Market cap (stock price*total share) and annual revenues for the past 10 years for the same 40 companies. And I got the following information.

I chose distribution because the price/sale ratio is much more volatile than I expected. Again, this is an internally inconsistent ratio, and you will only use it to decide when to sell a stock rather than buy.

Self-calculating GEHC industry Price/Sale

Estimated future price target investment banks will set

Decision time:

I will buy GEHC stock, which decreases to $66.3 per share.

I will sell half at $150,

1/4 at 180,

1/8 at 240….

I hope you found this post to be helpful.